Powered by

A Checkr Dispute That Goes

Beyond Basic Fixes

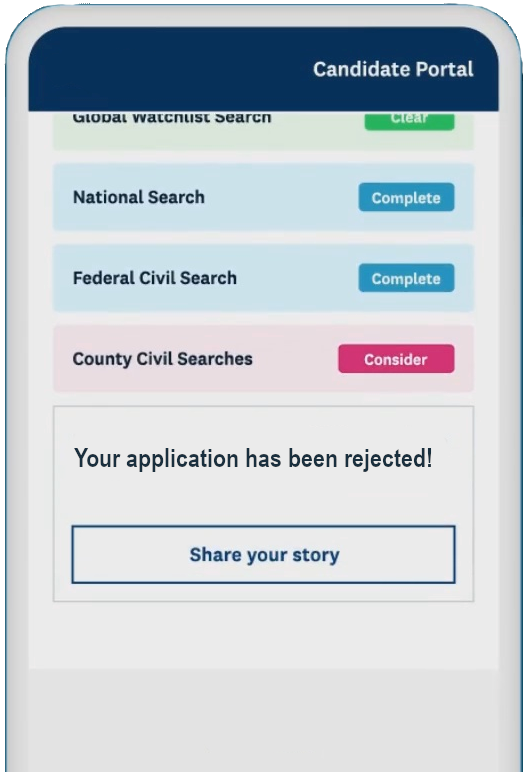

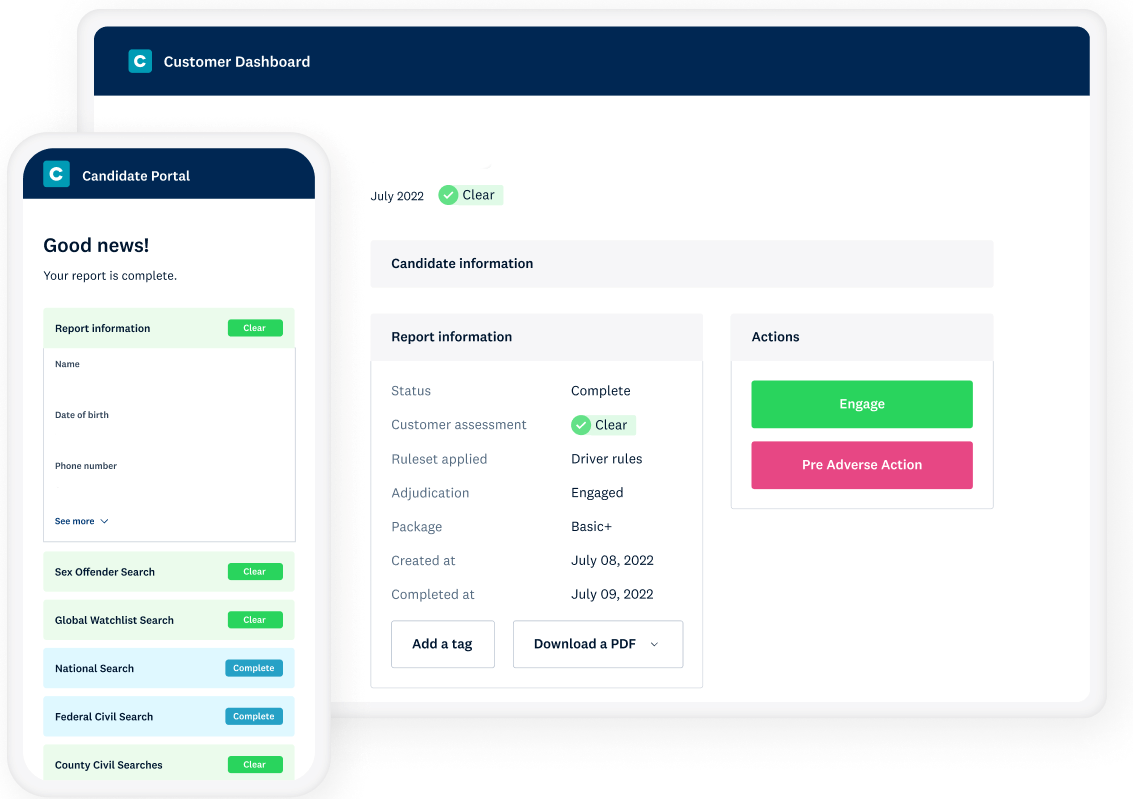

Deactivated Uber, Lyft, or other ride-share account?

Lost wages or a job offer because of a Checkr error?

Stuck with a false record on your Checkr report?

Resolving Your Checkr Dispute - Free Consulatation and Review

We provide the legal guidance you need to resolve your Checkr dispute!

Fix your Checkr report

Get compensated for damages

No out-of-pocket cost to you!

From Rideshare to Retail - We Help Workers Across Industries!

Legal Grounds for Filing a Checkr Lawsuit

You’ve been denied a job and lost income as a result of a mistake in your Checkr report.

Checkr did not resolve your background check dispute and failed to correct errors on your report.

You are seeking monetary compensation for the financial and emotional harm caused by Checkr’s reporting error.

Checkr Dispute Resource

Powered by Consumer Attorneys, PLLC we serve as a dedicated legal resource for individuals impacted by inaccurate Checkr background checks.

We assist workers from rideshare, delivery, and other industries who have lost jobs or income due to errors on their report, and we provide expert guidance for your Checkr dispute.

Our experienced legal team specializes in FCRA violations and is committed to pursuing a Checkr lawsuit to recover the highest possible compensation for damages - all with zero upfront fees or out-of-pocket costs.

When your livelihood is on the line, we are your legal solution.

10,000+ Reports

Corrected

25+ Years of Combined

Experience

$100+ Million Wages

Recovered

Why Choose Us

Our Goal Is Your Success

Our team of experienced attorneys has successfully settled numerous FCRA cases and has extensive knowledge of the lawsuit process. Our reputation is recognized by defendants, which allows us to resolve cases efficiently and promptly.

Reputation For Success

We have a history of successfully resolving hundreds of Checkr consumer disputes and compensation claims.

Defending Your Interests

We hold background check agencies and credit bureaus accountable, aiming to compensate consumers harmed by corporate negligence.

Our Legal Support Is Free

We don’t charge you out of pocket. Instead, we only get paid by the defendant after successfully settling your case.

You Should Know That

Dismissed criminal cases can only be reported for up to 7 years on commercial background checks. Expunged cases should not appear on your background check at all.

Reporting records or cases that do not belong to you on your employment or housing background check is a violation of your consumer rights under the FCRA.

Reporting incorrect dispositions, dates, or charge degrees is a violation of your consumer rights. The information should be reported with maximal accuracy!

Don't Fight Checkr Background Check Errors Alone - Help Is Available

We value our clients and are committed to helping them resolve errors on their background checks so they can get back to their normal lives.

Contact Us

Have you been a victim of an inaccurate Checkr report or have other questions about your background check? Contact us!